Part 1: Tax Powered GPT: Use AI to find Hidden Deductions in Minutes.

And finally take control of your business taxes

Hey AI Productivity Explorer,

I apologize. I never miss a week, but last week, I did. Trust me, it was for a genuine reason.

“What was it, Sameer?”

I caught up with some respiratory illness after my trip to Thailand.

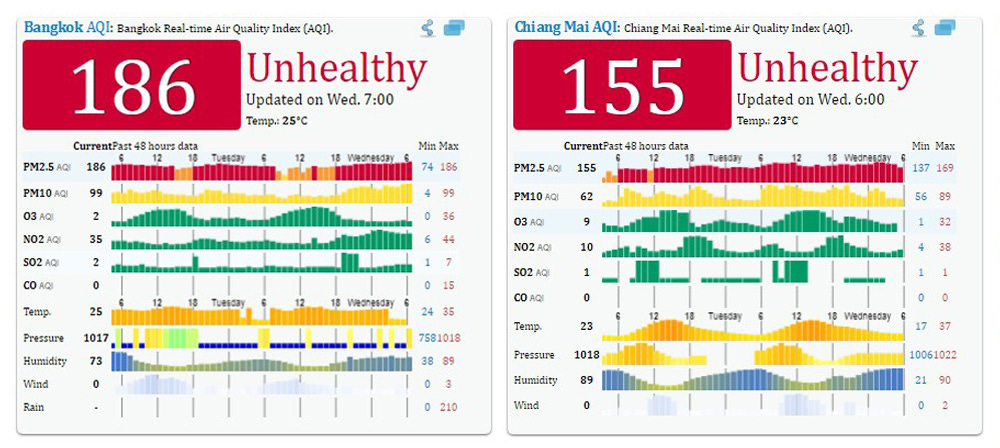

It was a fun two weeks with great food, AI consulting engagements, and sightseeing but the Air Quality Index (AQI) was more than 150 for several days of my trip.

This led to flu-like symptoms and severe congestion. Thankfully I am now clear and back in action.

Given we are in the Tax season, I thought I could create a detailed step-by-step post on how to use AI for business taxes.

I have divided this post into two parts because I really want to go deep using advanced AI Tax strategies. This week we will focus on two stages:

Stage 1: How to accelerate your Tax data prep using ChatGPT

Stage 2: AI-Powered Tax Deductions Analysis (Maximize Savings)

But first a disclaimer!

Disclaimer

I am not a CPA or a tax attorney. This newsletter post and guide are for informational and educational purposes only. It does not constitute legal, financial, or tax advice. While AI-powered tools like ChatGPT can help streamline tax planning and optimize deductions, tax laws are complex and subject to change. The accuracy and applicability of AI-generated insights depend on the information provided and should not replace professional judgment. Always consult a qualified tax professional or CPA before making any financial or tax-related decisions. Neither the author, the publisher, nor any affiliated entities, employees, contractors, partners, heirs, or assigns shall be held liable for any direct, indirect, incidental, or consequential damages arising from the use or reliance on the information contained in this guide. Use of this material is at your own risk.

So, for service businesses like us, it’s the same cycle every year i.e. scrambling to find all the receipts, second-guessing deductions, and hoping we don’t owe more than expected.

If you are like me then you will rush to your CPA and spend hours in their office to reconcile all reports. If you don’t rely on a CPA you may be using tax software, crossing your fingers that the default settings don’t miss a crucial tax-saving opportunity.

To be honest, we are all playing defense.

But what if this year was different? What if, instead of reacting to tax season, you engineered your tax strategy like a pro?

That’s what this guide is about.

It’s not a generic list of tax tips. It’s not another “reminder” to track expenses. It’s a structured AI-driven system designed to transform the way service business owners handle taxes.

By the time you finish reading, you’ll have a step-by-step ChatGPT-powered tax workflow that will:

• Extract and categorize your financials in minutes instead of hours

• Identify deductions most service businesses overlook and calculate real savings

• Optimize your tax strategy with income shifting, retirement contributions, and proactive tax planning

• Audit-proof your taxes before the IRS ever gets involved

• File accurately and forecast future tax scenarios to avoid surprises

Most business owners overpay in taxes because they don’t know what to look for. This guide fixes that by using AI as your personal tax strategist.

No more scrambling. No more missing out. This is how tax planning gets done in 2024.

Let’s get to work.

Stage 1: Data Extraction & Organization (Prepare Financials)

Most tax mistakes don’t happen when filing.

They happen months earlier when expenses are misclassified, income isn’t tracked properly, and business owners assume their accountant will magically “figure it out.”

Here’s the truth: Your tax strategy is only as good as your financial data.

If you’re manually sorting through bank statements or trusting a bookkeeping tool to categorize everything correctly, you’re setting yourself up for missed deductions and avoidable tax liabilities.

This is where AI changes everything.

Instead of sifting through transactions one by one, ChatGPT can automate the process, flag potential tax deductions, and help you structure your finances so tax season is painless. But before it can do that, it needs context so let’s define that.

Step 1: Set the Foundation with Smart AI-Driven Questioning

The biggest mistake most business owners make is they jump straight into deductions before defining their tax structure.

ChatGPT can’t optimize your taxes if it doesn’t understand how your business is set up. Before doing anything else, it needs to establish:

• Your business structure (LLC, S-Corp, Sole Proprietor, etc.)

• Your primary revenue sources (consulting, digital products, client retainers, software services, etc.)

• Your estimated total income for the year

• Your filing status (single, married, head of household)

By clarifying these details upfront, ChatGPT can tailor deductions, estimate tax liabilities, and ensure compliance.

Here is the prompt we will use to prep ChatGPT with your personal situation.

Keep reading with a 7-day free trial

Subscribe to Solve with AI to keep reading this post and get 7 days of free access to the full post archives.